When it comes to investing in Bitcoin, a thought comes to most minds: it’s risky and volatile. But what if I say the internet’s first decentralized currency is no longer a risky asset compared to how it was 12 years ago, around 2013?

What makes an asset risky and volatile? It’s obviously the uncertainty. In 2012-13, Bitcoin was very uncertain about its future, but over the decade, its uncertainty has significantly decreased.

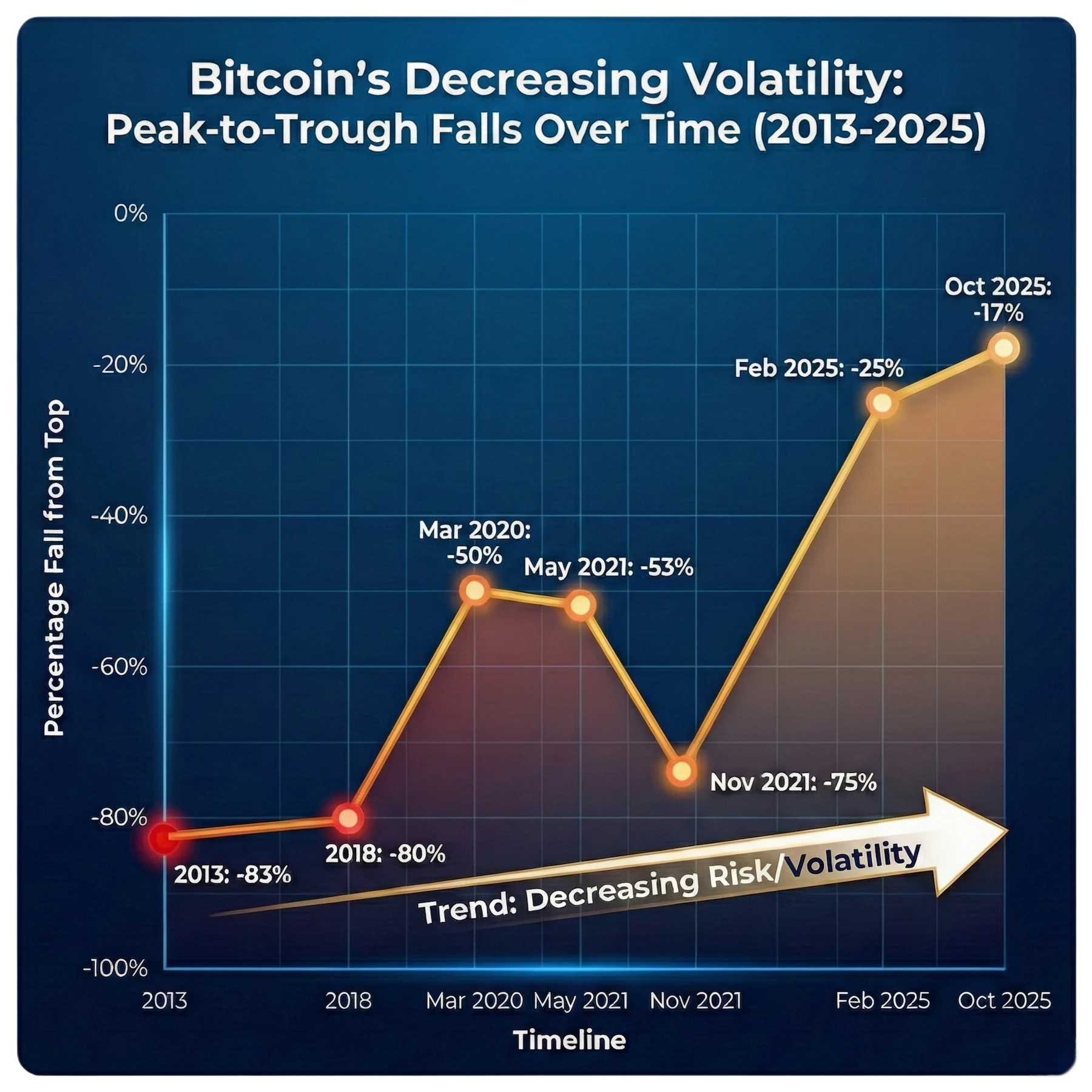

First, let me show you a chart with some interesting data. Read the chart and try to understand what the chart is trying to say:

From 2013, there are 7 major crashes in Bitcoin. The biggest crash till now is 2013, and the smallest crash is the recent one from October to November 2025, around 17 to 20% down from the top. From the chart, we could expect on average a 50% dip from the top in a future crash.

Between 2013 and 2020, people might think Bitcoin is a total gamble. That’s why people often buy and sell it for the short-term gain. As soon as people understood its value, the percentage of long-term holders increased over time, especially after the rise of crypto payment. Nowadays, many e-commerce shops have already started accepting Bitcoin and other stablecoins. So, Bitcoin is not just an asset to invest in; right now it is also becoming a way of exchange. Similarly, how a dude bought 2 pizzas at 10,000 BTC. We can still buy pizza today with Bitcoin, but it is only worth 0.0003 BTC.

In the early days of Bitcoin, there were fewer holders compared to today. Fewer holders with higher amounts in holding. As soon as technology evolved, security enhanced, crypto exchanges launched; the amount of Bitcoin holdings among retail investors increased, thanks to the social media boom after 2020. And hence, the corresponding risk and volatility in Bitcoin decreased more over the past 5 years. Wait, does it mean the return in Bitcoin will also decrease?

We all know that high risk is equal to high reward. And yes, as Bitcoin becomes one of the largest cryptocurrencies, its rate of return will decrease in the future. That doesn’t mean it is a total waste of investment. In the last 10 years, Bitcoin has given more than a 70% CAGR return. This is why we can expect a minimum 30% CAGR in the next 10 years.

As soon as retail participants increased, Bitcoin spread to the hands of more, which is definitely great for strengthening its support levels. Remember, there are only 21 million bitcoins; no one can print more like fiat currency when demand increases. Instead, we will see the rising value of Bitcoin over time.

In a previous article, we discussed how Bitcoin is actually not volatile for long-term holders. We have used the 4-year moving average to demonstrate the idea. You should check that article; it would be a good read. Ultimately, Bitcoin is no more risky for those who own it for the future, who understand it, and who believe in its blockchain technology.

Leave a Reply

You must be logged in to post a comment.