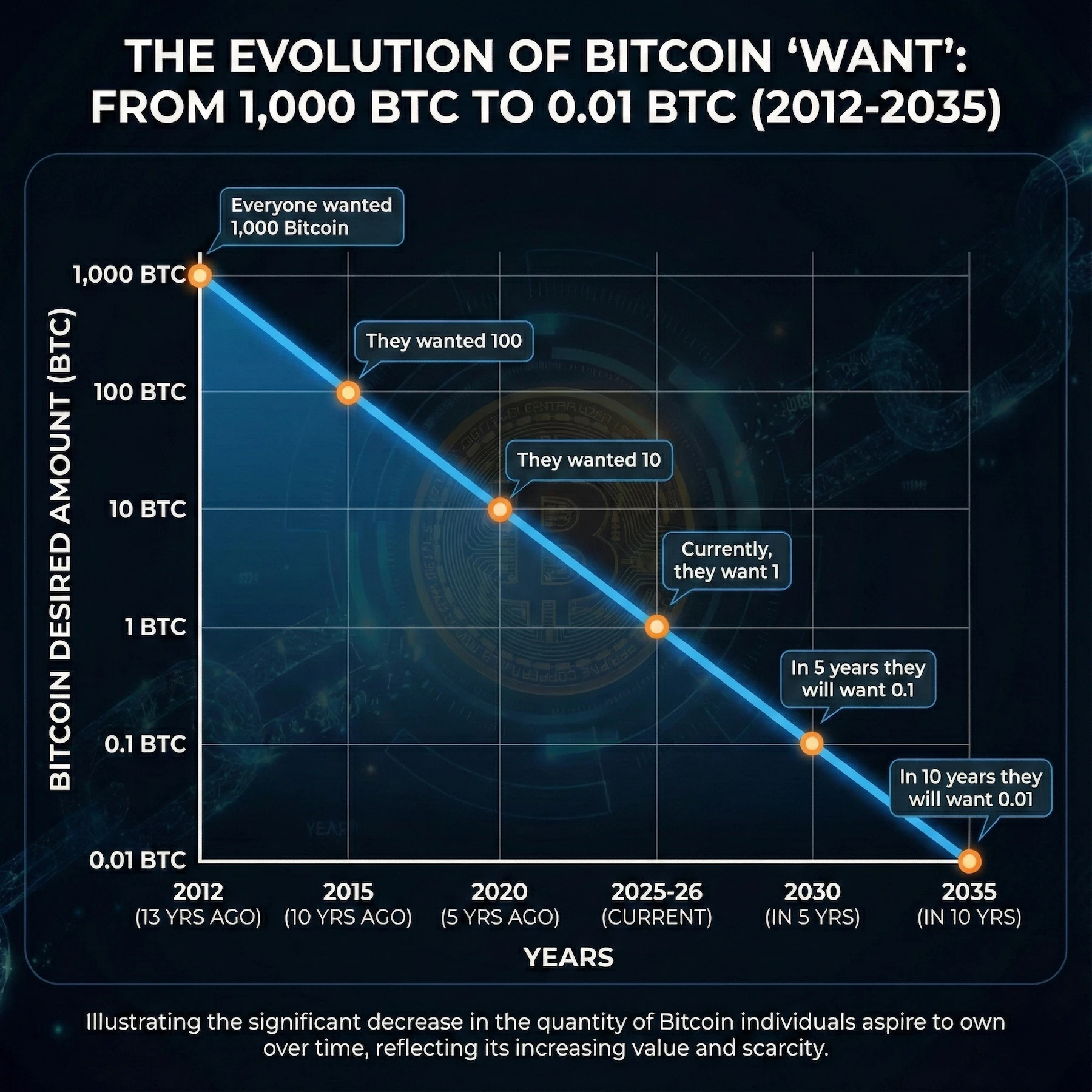

It has been almost 16 years since the launch of the internet’s first decentralized currency. Some lost their bitcoin wallet in a garbage dump, while someone bought 2 pizzas for the exchange of 10,000 Bitcoin. A thing is most noticeable here. Even though people want bitcoin in 2012 or today, the amount is not the same yet.

Here is a chart to quickly understand what I’m talking about:

As an individual, just ask yourself how many bitcoins you’d wish to own today. For most of us, it’s 1 Bitcoin. But what if I say if you even own 0.1 BTC, yes, 10% of a Bitcoin, owning it could make you ahead of 99% in the next 10 years, while everyone else would be chasing 0.01 Bitcoin.

It is similar to physical gold. It was $160.87 per troy ounce 50 years back; today it is $4,241.64 per troy ounce. Limited supply—that’s why demand and overall price increased over time. People are ready to pay more money or goods in exchange for gold. In the same way, the same thing is happening.

In 2012, people were ready to pay $10 for 1 Bitcoin; for the same coin, now they are ready to pay approximately $86,000 worth of goods or money, whatever you want in exchange. It’s similar to gold but not physically; it’s digitally.

So, how many bitcoins should you own? Basically, there is no limit on owning bitcoins, and it depends on individuals. But if your plan is to retire in the next 10 years, owning 0.1 bitcoin could do it. Of course, it depends on how much money you have to put in this asset. But for most of the working individuals, 0.1, or 10% of a Bitcoin, is the starting point, which could make you ahead of most of the others in the next decade.

If we see the history, Bitcoin has given a CAGR of approximately 75% over the last 10 years. While writing this article, Bitcoin is about $86,000, which means 0.1 BTC is worth $8,600. If we calculate 0.1 BTC ~ $8,600 with just 30% CAGR, in the next 10 years, it would become $118,558 in total. Surprising, right?

Remember, investing needs time and patience. That’s it. Doing DCA is the best way to systematically put some percentage of income without checking daily or weekly volatility. With DCA, we give control to the system to buy some satoshis every week or month. No need to time the market, and do whatever we love to do in our life.

Does this article change your perspective on chasing 1 Bitcoin? 1 Bitcoin could definitely make you retire or fulfill some luxurious desires today. But think tomorrow, the same luxury could be bought with just 0.1 Bitcoin. So, instead of chasing 1 BTC, why not collect Satoshis worth 0.1 bitcoin today, leave it for the next 10 years, and let the long-term price growth do the magic?

Good read? Share this article with your loved ones.

Leave a Reply

You must be logged in to post a comment.